Different Types of Startup Funding

The development of startups has become a global phenomenon, generating a value of over $6 trillion in 2021.

Technological startups stand out in this group, with between 1.5 and 3 million, depending on the definition adopted. Over the last ten years, they have raised nearly $1.7 trillion in funds, of which $621 billion in 2021 alone.

There are many ways to raise funds for startups. Their choice depends on many factors, such as the stage of startup development or the strategies for startups. Many startups also outsource IT services, which increases their chances of obtaining funds, as they can create a high-quality mobile application or other modern IT solution for reasonable money. But to implement each of the innovations, startups need money that they must raise.

Types of Startup Funding

Raising startup funds is a company's most exciting and demanding period. There are many types of startup financing. Each of them is different and requires in-depth analysis so that you can choose the variant that best suits your business needs. However, it can be overwhelming for novice entrepreneurs to analyze all the financing methods independently. If you have never heard of equity funding, venture capitalist, angel investor, or equity stake, read our article and evaluate which types of funding are best for your business.

You can obtain a loan for your company through banks and other financial institutions. Each lender will carefully analyze your application and consider various factors. Therefore, you need to be sure that your business plan is carefully prepared, and everything is accurate in it. As with a personal loan, you must have solid business credit. It will help you get a loan with a lower interest rate and, therefore, simply cheaper.

Spend your loan wisely and on schedule, as you are unlikely to get a second loan soon after getting the first. Therefore, plan your expenses, analyze prices, and make reasonable decisions.

Venture capital is often invested in young companies with high potential, which usually deal with innovative technologies or IT. It is addressed primarily to startups or projects with a significant chance of success and development potential. It consists in providing capital to the company by an external investor (venture capital firm) - a specialized entity operating in the form of a fund - in exchange for shares in the company. It means that venture capital firms become co-owners of the company they support.

Capital providers in Venture Capital funds can be private individuals, e.g., business owners, government agencies, pension funds, banks, insurance companies, or corporations.

A business angel is a term for a private investor who supports the development of other entrepreneurs. He usually has extensive business experience and, in addition to financing, offers extensive substantive knowledge and an extensive network of business contacts.

It is much more than banks or insurance companies can offer. However, in exchange for funds for business development and management consultancy, business angels receive company shares or bonds. The advantages of cooperation with a business angel undoubtedly include that the contract with him does not require collateral in the form of personal assets and own money.

The relationship with an angel investor is closer than in the case of other forms of financing. Therefore, both parties must communicate well and have a coherent business idea. The fact that the company's arrangement with a business angel is less formal than cooperation with a bank or VC fund also brings other benefits - private investors make decisions to allocate capital in business based on less analysis and primarily based on previous experience and business intuition. In addition, they can invest in projects at every stage of their development - both at the early stages and in the final phase.

Funding Rounds are times when companies seek different types of funding. It's a type of equity financing that gives investors a stake in a company in exchange for an investment in your startup. The rounds are divided into 5 series marked with successive letters of the alphabet, e.g., series A, series B, etc. Series A funding follows pre-seed funding and depends on the startup's business planning. The rest of the series follows as the startup grows and generates revenue.

Series A Financing

The A series is a phase optimizing, e.g., a product or service. Financing from this phase should be used to adapt products to the market or customers and improve sales and other business and technological processes.

Series A funds are usually from a venture capital firm, although business angels may also be involved.

Series B Financing

When the startup consolidates its position on the market, then series B financing comes in. Series B is a phase that allows you to scale the business by increasing the scale of operations, e.g., creating products for new markets. Series B financing allows you to prepare for a wide expansion.

Series B funding is usually from a venture capital firm, often owned by the same investors who led the previous round. As each round adds up with a new start-up valuation, previous investors often choose to reinvest and raise capital.

Series C Financing

Series C funding is for startups that can develop and implement additional products and expand the scope of their activities locally and abroad. As a rule, they are interested in increasing their valuation before the initial public offering (because they are preparing the company for the stock exchange debut). Many companies have stopped fundraising at this point.

Series C funds usually come from venture capital firms investing in late-stage startups, private equity firms, banks, and hedge funds.

Series D Financing

The Series D funding round is more complex than previous rounds. Because many companies end their fundraising round C, only some startups make it to Series D. As a rule, and they want to expand their activities because they have discovered, for example, a market niche or a product innovation. They want to further expand their activities even before the stock exchange debut.

Another reason is the fact that some business owners want the organization to remain in private hands as long as possible.

A venture capital firm usually funds series D rounds. The instruments and valuations obtained are accurate because only some startups have reached this stage.

Crowdfunding consists of obtaining funds to implement various projects from various entities interested in allocating capital for a project. It is an extremely popular form of financing many projects, and crowdfunding platforms have revolutionized how startups are funded.

You can apply for funding for almost anything legal. Projects often funded this way are games, applications, electronic gadgets, and sometimes intangible things. Examples are bands that collected money from fans in this way to release an album or organize a concert tour and producers who were looking for funds to make a film.

Many of the products that appeared on crowdfunding sites a few years ago are now widely used. An example of a particular success from the world of electronics turned out to be a device using virtual reality technology - Oculus. Over $2.4 million was raised for its implementation.

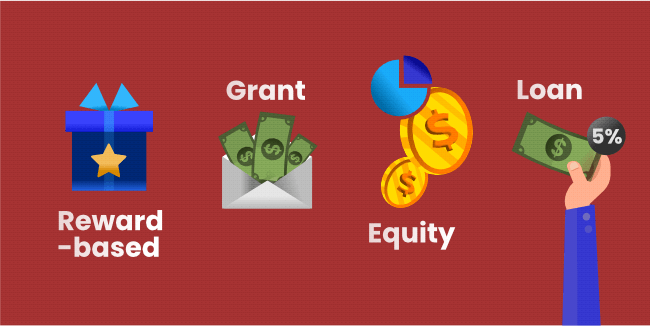

Depending on what motivates investors to financially support a given project, at least several types of crowdfunding can be distinguished: prize-based crowdfunding, grant crowdfunding, equity crowdfunding, and loan crowdfunding.

Reward-based Crowdfunding

In exchange for donations, donors receive various rewards, such as autographs or commemorative medals, determined by the person organizing the fundraiser.

Grant Crowdfunding

Donations to the beneficiary of the collection do not involve any expectations or promises of return, which means that from the founder's perspective, all donations are made out of pure generosity. From a legal point of view, this means that these contributions are simply donations.

Equity Crowdfunding

In this way, the investor who contributes his capital to the project becomes an integral part of the company and receives certain ownership rights.c

Loan Crowdfunding

It is a form of social lending that allows entities to receive funding with an obligation to return what has been paid with interest.

A startup incubator is a structure that supports young companies in their development. Its goal is to provide support in the field of financing, hosting, or management consulting that will help young innovative enterprises succeed in the first phase of development, i.e., pre-seed and seed.

In this phase, there is a business idea. Still, the way to turn this idea into a viable business project has not yet been determined.

Conclusion

There are many ways to raise funds for startups. Some companies need huge capital to make their ideas a reality. In contrast, others need only a small loan to achieve higher income and financial freedom. Whatever the case for your business, creating a clear business plan and determining your current financial needs is best. It will help you choose the right path.

Our company has been cooperating with startups in creating successful software products for many years. If you want to explore this topic, make an appointment for a free consultation with our specialists at a convenient time.